RBI allows payment for International trade in Rupee

India is one of the world’s largest importers of goods and services and its most of the import settlements are in dollars. Because many countries around the world accept only dollars for settling international trades. All over the world, demand for US dollars is high and many countries prefer to keep their money in dollars because they know how much they can spend.

To strengthen the Indian currency the Reserve Bank of India (RBI) allows payment for international trade in Indian rupee. This move could lead to greater demand for rupees, which would strengthen the currency. As a result, more demand equals more value and there might be less pressure on the central bank to raise interest rates.

On 11th of July 2022, the Reserve Bank of India made an announcement “Domestic traders could settle their imports and exports in Indian rupees”. This means that companies importing goods into India will no longer have to worry about getting paid in dollars. Instead, they’ll be able to use rupees to buy raw materials and sell finished products to customers.

In turn, this will give India more credibility as a place where businesses can do business. More importantly, it will also boost the amount of trade taking place in rupees.

What is the RBI Strategy behind bringing “International Trade Settlement in Indian Rupees” System?

Main reason is Eastern Europe countries war due to that the American sanctions removed Russia from the “Swift network” system. This has brought several trade challenges for India and many other countries. Currently, remember that the majority of trade settlements are done in USD and EUR. As a result, each nation’s banks have their VOSTRO accounts in either European or American banks, including Russia and India. However, when Eastern Europe countries war started, the western countries were infuriated. Consequently, America seized all payments made in USD and barred Russia from the SWIFT network. These regulations basically indicate that if a Russian bank has USD kept in their VOSTRO account, they won’t be able to pay for imports or purchases, even if it is intended for India! The same was accomplished by Europe, hence EUR funds were also frozen. Trading with US and European organizations was banned for Russia anyway but unfortunately, they couldn’t give nor receive payments from India in USD since they were blocked off from accessing their own VOSTRO accounts kept in US banks. Somehow India has to do imports and exports with Russia. To facilitate Indian imports and exports with Russia, the Reserve Bank of India created an alternative system known as “International Trade Settlement in Indian Rupees (INR)”.

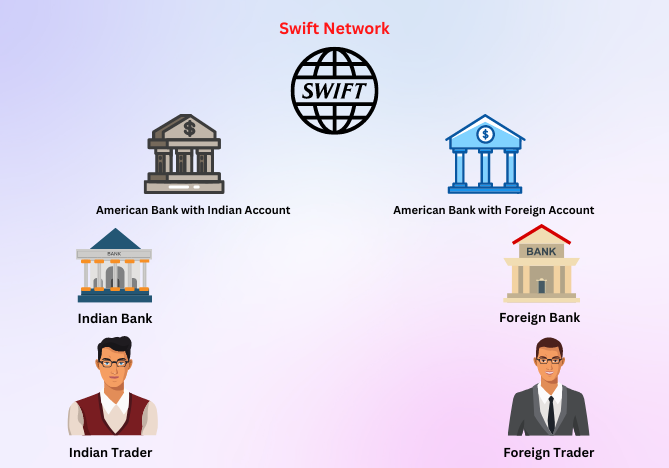

How does the existing swift network work?

The Swift network usually involves 6 different entities. For Example those are,

- Indian Trader

- Indian Bank

- American Bank with Indian Account

- Foreign Trader

- Foreign Bank

- American Bank with Foreign Account

The Indian bank will have an account in the American bank where it has money in dollars. Similarly each nation’s banks have their accounts in American banks where they will store their money in dollars. Because only US banks can hold dollars.

If an Indian trader imports Pearls and precious stones from China. Indian trader cannot make direct settlements to China trader through their correspondent bank of the country. Indian trader has to pay indian bank, Indian bank will debit amounts from trader account and it will send message to their dollar account in American bank to transfer equivalent amount of money (which calculated in dollars based on the current exchange rate) to China’s dollar account in American bank. Once the amount is received, China’s national bank will settle the equivalent amount of Yuan (CNY) to the China trader where he holds the account.

The entire transactions are done through the Swift network. This network is tightly controlled by the US and Europe. More than 50% of international trades are done through the Swift messaging network system.

How does the RBI’s “International Trade Settlement in Indian Rupees” System works?

The RBI allows foreign banks to open Rupee Vostro Accounts. These are similar to current accounts except that there is no limit on the amount of money you can deposit. You can use it to settle international payments.

You can link your Rupee Vostro Account to your bank account. Your bank will deduct the amount from your savings account and transfer it to your Rupee Vostro Account.

This way, you do not have to worry about exchange rates. If the rupee falls against counterparty currency, your bank will automatically adjust your balance accordingly.

If you want to convert your rupee balance to dollars, euros or pounds, you can go to any Bank and ask them to do it. They will charge you a fee.

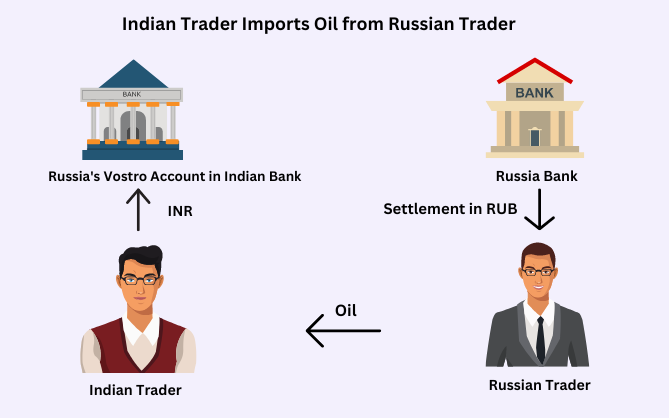

1) Consider an Indian Trader imports Oil from a Russian Trader

An importer in India pays 250 million INR (25 crores in INR) to their bank and gives instructions to his bank, saying: “Transfer this entire amount from my account to the Vostro account of the Russian bank”. It’s for the Oil shipment they just obtained.

In return, the Russian bank states, “Oh look, The Vostro account of mine has received 25 crores INR. Therefore, if the current foreign exchange rate is Rs.10 INR for every RUB, I’ll transfer 25 million RUB to the Russian exporter”.

So in conclusion, The Russian trader earns 25 million RUB in his account.

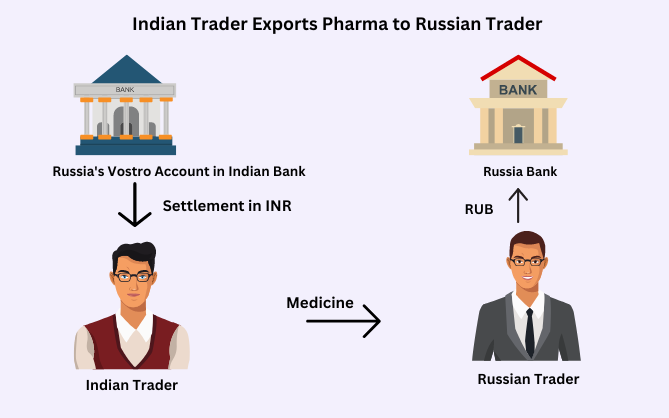

2) Consider an Indian Trader exports pharma to a Russian Trader

An importer in Russia pays 25 million RUB to their bank and gives instructions to his bank, saying: “Transfer the equivalent amount of INR to the Pharma exporter from the Vostro account of the Russian bank which is held in India”.

Therefore, the Vostro account of the Russian bank calculates the settlement amount (Eg:- if the current exchange rate is Rs.10 INR for every RUB) and it transfers 250 million INR to the Indian exporter’s account.

So in conclusion, The Indian trader earns 250 million INR in his account.

Meet Rajesh

I am Rajesh from India, the founder and owner of byrajesh.com

Currently I am working as an Automation Test Analyst in an MNC Company, while working in a comfortable position I always think of my future and next move.

COPYRIGHT ©2022, BY byrajesh. ALL RIGHTS RESERVED.