Chit Fund: Types of Chit Funds, How Do Chit Funds Work?

What Is A Chit Fund?

A chit fund is a form of investment which allows a group of people to put up small amounts of cash and earn interest on it over a definite period of time under a Chit agreement. Actually You don’t buy shares in the company, rather you lend your money out to Chit Subscribers through a bidding process and receive regular payments of dividends in return.

Chit Funds tend to help middle class or Lower middle class people?

Yes, it provides the finance to Small investors, Farmers, Womens and Businessmen without any Collateral. Consider you have a plan to start a business but you don’t have enough capital to kick start your business in this situation you will approach Banks or Private Moneylenders or Friends for loans but all of them will expect the asset as Collateral. If you don’t have an asset it will be difficult to get the loan from them. That’s why “Chit funds” comes into the picture.

How Do Chit Funds Work?

Chit funds are a unique combination of Savings, Loan and Investment. That investors can save money at the same time borrow any time the need arises, moreover there is no interest charged on borrowing and one can borrow whenever and for whatever purpose. In this, a group of contributors who put some amount of money every month for 20 months or 40 months based on the Chit fund scheme and through competitive bidding each contributor gets to win the bot once.

The auction process will be conducted by a Chit Organizer (foreman) and he will charge 5 to 7% as a commission.

Types of Chit Funds

Based on the chit organizers, Chit Funds are classified into three types. Those are,

1.Funds run by State governments

2.Private registered chit funds

3.Unregistered chit funds

1.Funds run by State governments

These kinds of Chit Funds run by State Governments. For instance, the Kerala State Financial Enterprises (KSFE) and Mysore Sales International Limited (MSIL) are Public Sector Undertaking (PSU) that run the Chit fund business in a clean & transparent manner.

2.Private registered chit funds

These kinds of Chit Funds run by Private. For instance, prominent business houses are Margadarsi Chit Fund and Shriram Chits. These are government registered Chit fund companies which means supervised under the supervision of the Securities Exchange Board of India (SEBI). SEBI regulates chit funds and ensures that they follow the rules set by the regulator. Investors must register themselves with SEBI before investing in any chit fund. Once registered, they cannot withdraw their money without giving reasons.

People should invest in registered chits. If you invest in a registered chit fund, you know exactly what you are getting into. You don’t have to worry about anything.

If you decided to invest your money into government approved chit fund scheme, that chit fund scheme included 40 members who had to contribute Rs.20000 (Based on the scheme, installment amount, number of members & months will get differ) every month until 40 months with the lump sum being worth 8 Lakhs every month which would go to one member via competitive bidding till all 40 members get to take the pot once. Auction will happen on an announced date of every month.

First month each one contributed Rs.20000 to the foreman. Person A, B, C and D needed funds urgently and decided to participate in the Auction first month itself. During auction time, the person who bids the maximum discount will win the lump sum amount. Person A decided to forgo the maximum limit of the bid permitted and won the bidding as well. Person B, C, D and A quoted the bid amount as Rs.125000, Rs.150000, Rs.175000 and Rs.200000.

Auction ended with Rs.200000, Person A will get Rs.600000 as lump sum amount. A Foreman (CHIT ORGANIZER) will take the commission of 5% (CHIT VALUE) which means Rs.40000 (5% 8 Lakhs) from Auction amount (Rs.200000) and the remaining amount (Rs.160000) will be distributed to all 40 members.

At the end of the First month auction others benefited in their share of ₹4,000, each one had to contribute Rs.16000 to Foreman instead of Rs.20000.

Person A has to contribute installment amounts every month until 40 months & cannot participate in bidding likewise the member who took the lump sum amount cannot participate in upcoming months bidding.

Mostly a person who took the pot amount tends to default their installment amounts in upcoming months.

Suppose in a particular month all chit subscribers are not interested to take the pot amount, Chit organizer will select the pot winner based on lottery.

A registered chit group will return all the money deposited within 90 days after the scheme ends. However, the group doesn’t guarantee the returns. So, it is wise to invest only a small part of your savings in such schemes.

3.Unregistered chit funds

These kinds of Chit funds run by Private but they didn’t register with the government which means not supervised under the SEBI. Participation in unregistered chit fund schemes should be avoided. You could lose your money.

These kinds of Chit fund schemes are unregulated investment opportunities that promise high returns. They are usually advertised through door-to-door salespeople, telemarketers, social media ads, etc. Most chit funds do not pay out monthly interest; rather, they offer upfront returns. In some cases, the investor receives his/her initial capital back within just one day.

Unregulated chit funds are often operated by people who know each other well. This makes it easy for them to cheat investors. For example, scammers might tell you that you will earn 10% per week, or even 20%. But once you make the payment, there is no return. If you want to avoid being cheated, try to find a registered chit fund scheme.

Even in process wise Unregistered chit funds also happen like Private registered chit funds, Only difference is not supervised under the SEBI.

Features of Chit Funds

- Fixed repayment period

- Prepayment option

- Flexible tenure options

- Low initial cost

- Easy documentation requirements

- Avail it whenever and whatever purpose

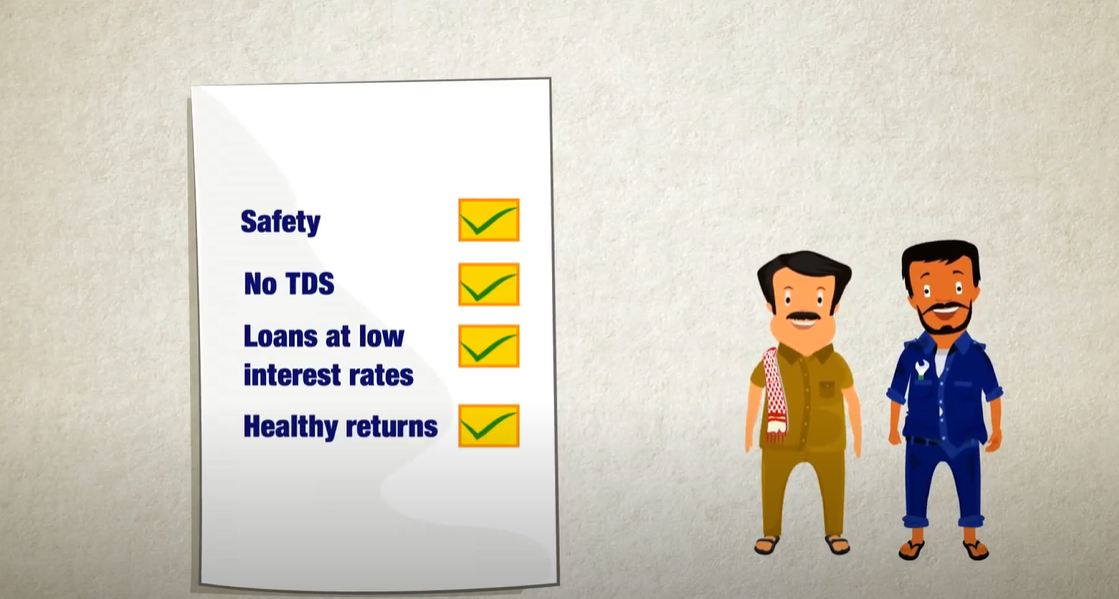

Advantages of Investing in Chit Funds

Chit funds offer many advantages over bank deposits. Here are some of them:

- Flexibility – You can invest your money in chits anytime, anywhere.

- Low cost – Unlike banks, there is no fixed deposit interest rate. Instead, you pay a small amount every month.

- Tax benefits – As mentioned above, there is no tax liability on dividends earned.

- Financial inclusion – Chit funds give loans to poor people and women entrepreneurs without surety.

- Savings – By investing regularly, you can build up a corpus. And, you don’t have to worry about inflation because you will earn interest on your investments.

- No interest – Chit funds give loans to chit subscribers without interest.

- No questions – Chit Subscriber can avail their pot amount whenever and whatever purpose

Risks Involved in Investing in Chit Funds

In Chit Funds, Chit organizers and subscribers are liable to credit risk because a person who took the pot amount tends to default their installment amounts on their periodic payments.

Unregulated Chit funds are carrying high risks, they are basically a pool of money where people deposit money and earn interest. In some cases, the person managing the chit fund might misappropriate the money. This happens quite often because there is no proper regulation.

At the same time, If the person who took the pot amount didn’t pay the installments for upcoming months means the Foreman (Chit Organizer) has to take the responsibility or ownership that’s why they are taking 5 to 7% amount as Commision. Once

There are many cases of fraud involving chit groups. Some chit groups promise returns of up to 20% per month. But once you make a payment, it is difficult to withdraw the amount. You could lose everything.

Investors should check whether the chit fund is registered or unregistered before making any investments. A registered chit group pays back all deposits within 90 days after the completion of the scheme

Top 10 Chit Fund Companies in India

- Shriram Chits

- Margadarsi Chit Funds

- Kerala State Financial Enterprise (KSFE) – Government of Kerala

- Mysore Sales International

- Purasawalkam Santhatha Sanga Nidhi Limited

- Amruthadhara Chits and Finance Private Limited

- Kapil Chits

- Guru Nanak Chit Fund

- Gielle Investments Ltd

- Louis Chit Funds Private Limited

Tips Before Investing in Chit Funds

- Ensure Chit fund Company registered in SEBI

- Don’t get involved in multiple Chit Schemes

- Make sure you are able to pay the installment amounts throughout the chit fund cycle

- Try to avoid taking the Pot amount in festival seasons because you will end up getting an low prize money due to more competition

- Select the chit fund company which is taking low commission for chit management

- Decide the maximum bidding amount before get into the auction once your range is crossed let others to take the pot amount

- Don’t select the scheme beyond your capacity

- Don’t reveal your maximum bidding amount to other Chit subscribers it will backfire you

Meet Rajesh

I am Rajesh from India, the founder and owner of byrajesh.com

Currently I am working as an Automation Test Analyst in an MNC Company, while working in a comfortable position I always think of my future and next move.

COPYRIGHT ©2022, BY byrajesh. ALL RIGHTS RESERVED.