RBI’s proposal on UPI charges and seeks public feedback

Unified Payment Interface (UPI) was launched in April 2016. It is a very popular fund transfer system, which is convenient and fast. Real Time Gross Settlement (RTGS) and National Electronic Fund Transfer (NEFT) also facilitate merchant payments; however, they are not popular channels for day-to-day purchase of goods and services because – (a) RTGS requires a large amount of money to be transferred, and is mostly used for business-to business payments; and (b), NEFT is not an instant payment system and confirmation of receiving funds in the merchant’s account takes time. UPI, unlike these, facilitates instantaneous credit with real-time confirmations and It allows users to make instant transfers between accounts held with banks across India without having to wait for days for clearance.UPIs are similar to IMPS.

UPI has brought revolutionary changes in the payment ecosystem of India, with more and more consumers signing up to pay via the system. At present, transactions made through UPI (Unified Payments Interface) are free of charge. However, the Reserve Bank of India requested feedback from stakeholders on the possibility of introducing a tiered fee structure for such transactions.

What is UPI?

UPI stands for Unified Payments Interface. This is a new system developed by NPCI (National Payments Corporation of India).This new system allows customers to send or receive payments from their bank accounts using their mobile phones and it offers several benefits such as faster processing time, lower fees, less paperwork and no requirement of pre-approval.

UPI is an app that allows banks to merge their various services into a single mobile app. It enables seamless fund transfers between different bank accounts. Merchants can accept payment through UPI by linking their bank account to UPI.

UPI offers two main services: instant fund transfer and account balance transfer. Instant fund transfer allows customers to transfer funds instantly between accounts held in the same bank or financial institution, while account balance transfer enables customers to transfer funds between accounts held in different banks or financial institutions.

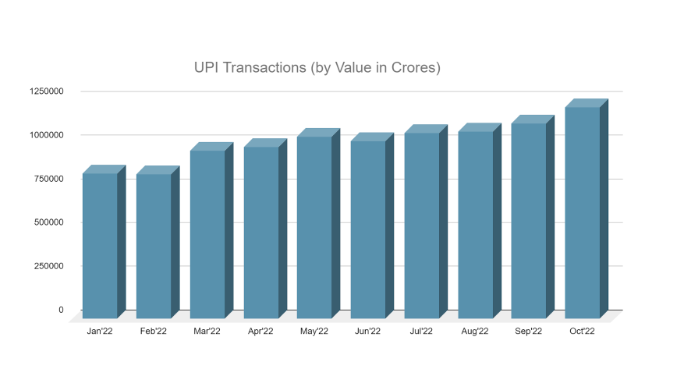

UPI Transactions Growth

MDR (Merchant Discount Rate) is the amount paid by a merchant to the card issuing bank for an offline transaction and to the gateway/payment processor for an online purchase.

In January 2020, India’s central bank scrapped the merchant discount rate (MDR), a fee charged by banks and credit card companies for processing payments made via Unified Payment Interface (UPI). The move led to an increase in the number of people paying via digital wallets such as Paytm and UPI, Indians doing transactions minimum 1 billion dollar every day on digital wallets.

The Covid-19 pandemic period has accelerated the use of digital payment methods such as UPI. National Payments Corporation of India (NPCI) has shared the Statistics, which shows transactions done through UPI getting increased month by month.

At the end of Oct-22, transactions done through UPI reached the new height which is Rs.1211582.51 Crores.

UPI Transactions are classified into 2 types. Those are,

- Person to Person (P2P)

- Person to Merchant (P2M)

1.P2P – Person to Person Transaction

Peer to Person (P2P) transactions are payments made between two individuals

2.P2M – Person to Merchant Transaction

Peer to Merchant (P2M) transactions are payments made by one individual to Merchant

Reason for the RBI Proposal on UPI Charges?

On UPI, Merchant Discount Rate stands at zero, whereas for most cards, credit and debit, there’s an additional fee of 2 to 5%. UPIs are used to transfer money between two parties. They work similarly to Immediate Payment Service (IMPS). They are so similar, they should follow the same rules.Therefore they should have similar charges. However, I think that the charges should be different because they are not the same thing. In an IMPS transaction, both parties pay fees to the bank.

The Reserve Bank of India (RBI) has responded to reports that it plans to levy transaction fees on Unified Payments Interface (UPI). In a statement published on Twitter, the central bank said that while it does plan to introduce some charges on UPI transactions, those charges will be limited to certain types of transactions.

On Wednesday, 17 August 2022, the Reserve Bank of India (RBI) released a discussion paper, asking industry players to comment on what they think about the idea of charging fees on various payment services including Unified Payments Interface (UPI), Real Time Gross Settlement System (RTGS), National Electronic Fund Transfer (NEFT), Immediate Payment Service (IMPS) and others.

Now UPI requires a special mention in this discussion paper, as not only does it act as a fund transfer protocol, but also acts as a merchant payment system too.

The discussion paper states that based on the feedback and comments received until the 3rd of October, the RBI Working Committee would endeavor to stipulate policies and guidelines for the different payment services.

Some people argue that the Reserve Bank of India (RBI) should not charge for using its Unified Payments Interface (UPI). Others say it would be good if they did because it would help develop better infrastructure for their most popular payment rail, which could lead to more adoption and other metrics like improvement of transaction success rates.

What will be the Potential Effects of The RBI Proposal?

This RBI’s new rule could impact users of digital payments platforms, UPI, such as Gpay, PhonePe as well as Banks and their users. Under the proposed scheme, the Reserve Bank of India will require companies and banks offering digital payment services through Unified Payments Interface (UPI) to collect transaction fees from their customers while providing a framework for such charges.

1.P2P and P2M UPI transactions

In P2P Transaction – We’ll look at bank transfers, which are free of charge for up to a certain amount, but beyond that they’ll cost you.

In P2M Transaction – There would be an MDR which would come into play. It could be slightly cheaper than what is charged by debit cards.

2.Small Merchants

Especially the roadside vendors and small businessmen are likely to be hit the most if we have a flat MDR structure (we will mostly not have this, it will be a tiered basis of their average monthly volumes).Many of them might even prefer cash rather than accepting card payments.

Meet Rajesh

I am Rajesh from India, the founder and owner of byrajesh.com

Currently I am working as an Automation Test Analyst in an MNC Company, while working in a comfortable position I always think of my future and next move.

COPYRIGHT ©2022, BY byrajesh. ALL RIGHTS RESERVED.