How to download Form 16 from traces? – Online

Table of Contents

ToggleWhat is Form 16?

Form 16 is a confirmation certificate issued by an employer that TDS has been deducted and deposited with the government on behalf of the employee in a particular financial year.

It is a TDS Certificate issued by an Employer to the Employee.

Parts of Form 16:

Form 16 consist of 2 parts

Part A

Part B

Form 16-A:

The Primary component of Part A include these details

- Name and address of the Employer

- Name and address of the Employee

- PAN and TAN of the Employer

- PAN of the Employee

- Period of employment

- Summary of amount credited and tax deducted quarterly basis

Employees have access to download Part A of Form 16 from TRACES.

Form 16-B:

The Primary component of Part B include these details

- Salary Breakup

- Total Taxable Income

- Net tax payable

- Exemption under section 10

- Tax Deducted

Employee cannot download the Part B of Form 16 directly from TRACES, Final TDS Certificate will be provided by Employer/Deductor

If you have worked with more than one employer during the year, you will have more than one Form 16.

Your employer is responsible for providing you with the form 16. Even if you are part away from your previous company, you can get your Form 16 from your previous company. If you have missed it, you can download it using the following steps:

Steps to Download Form 16

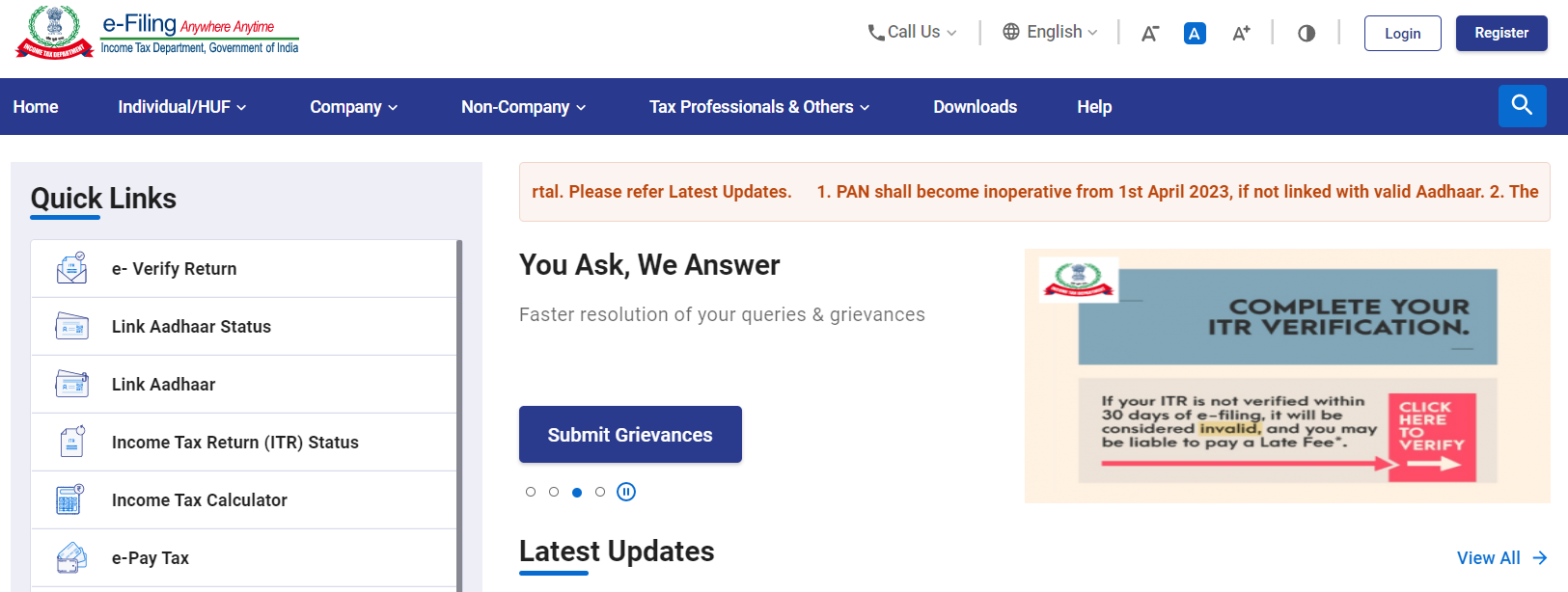

1.Login to Income Tax Portal

Click “Login” & it will navigate to Login Page

Enter the “PAN Number” in User id & Click on “Continue”

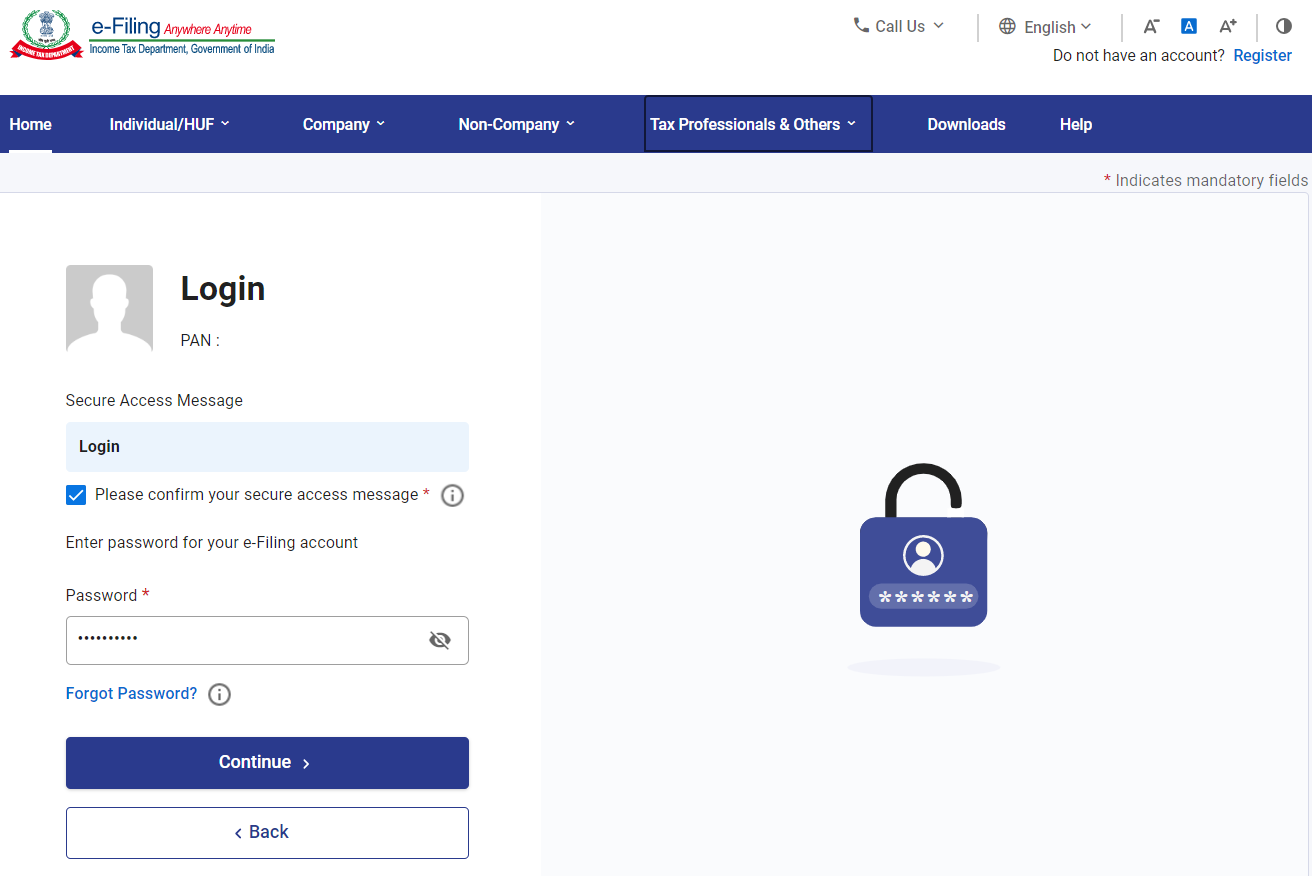

2.Select the Secure Access Message Checkbox

Enter your “Password” and Click on “Continue”

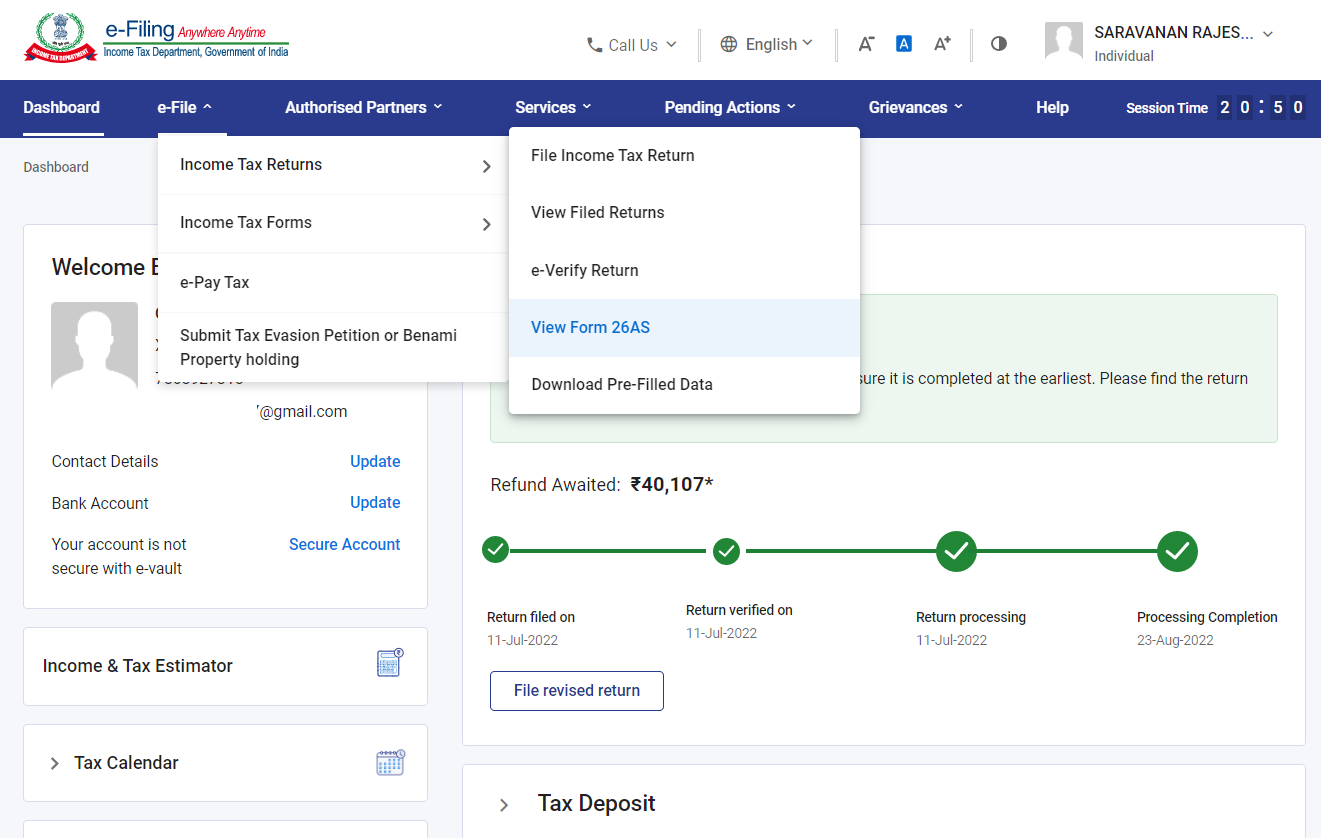

3.Navigate to View Form 26AS

Go to e-File > Income Tax Returns >View Form 26AS

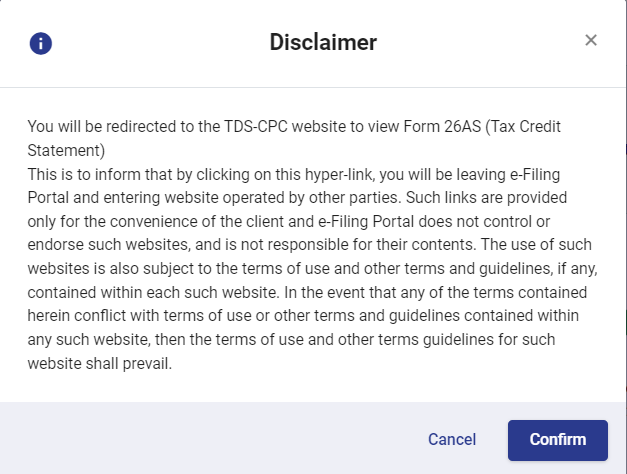

4.Confirm the Disclaimer

Click on “Confirm” button in the Disclaimer popup and it will launch you to the TRACES Portal in new tab

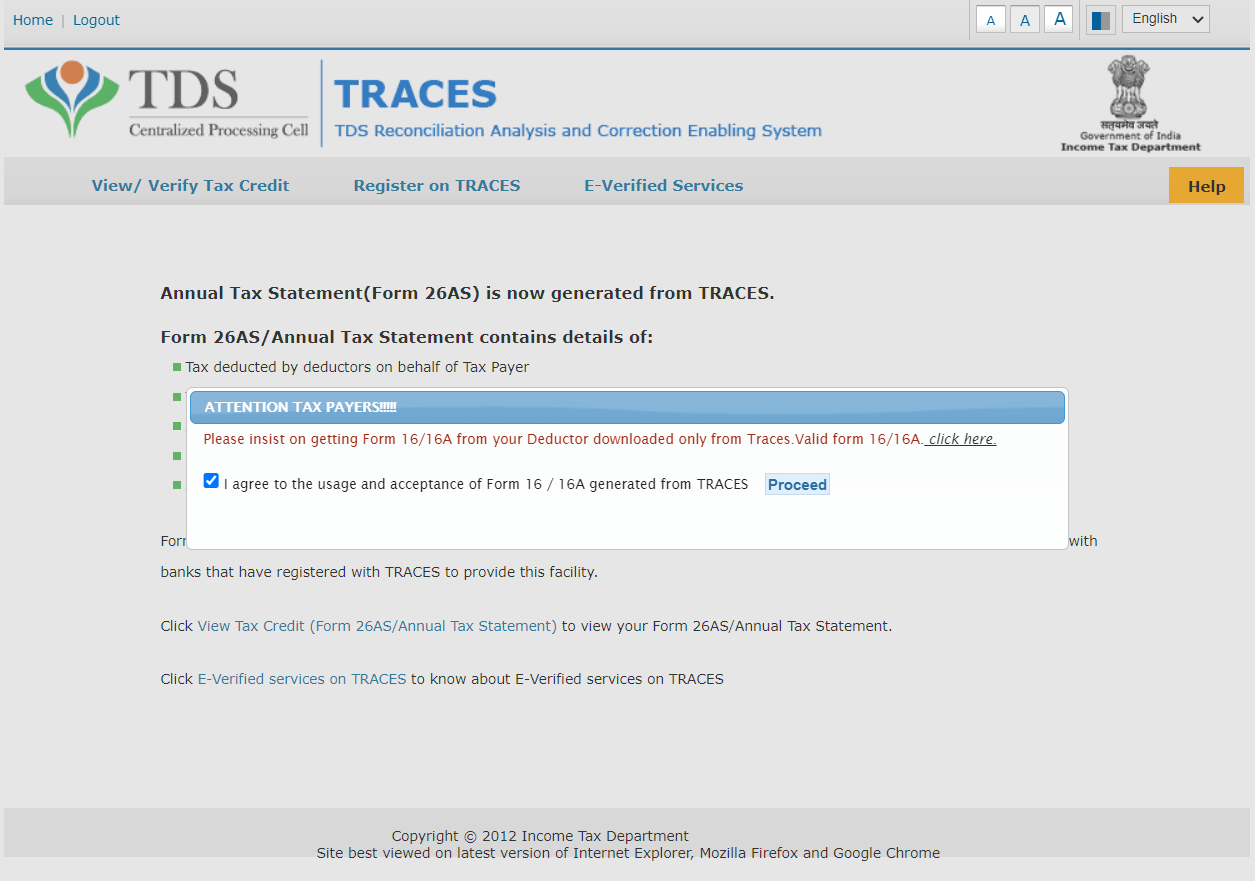

5.Navigate to TRACES Site

Select the Checkbox in “Attention Taxpayers!!!” popup and Click on “Proceed”.

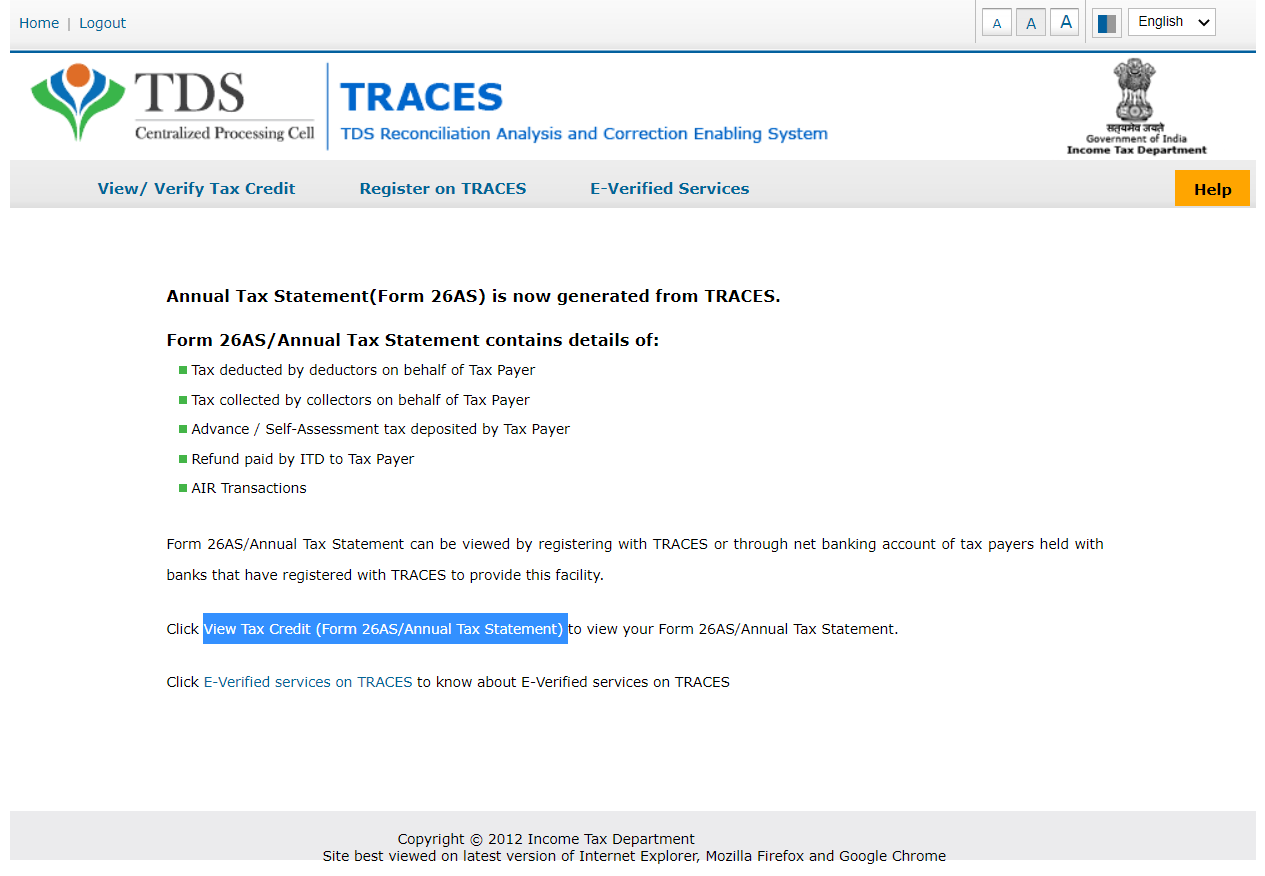

6.Click on View Tax Credit

Click on “View Tax Credit (Form 26AS/Annual Tax Statement)” link

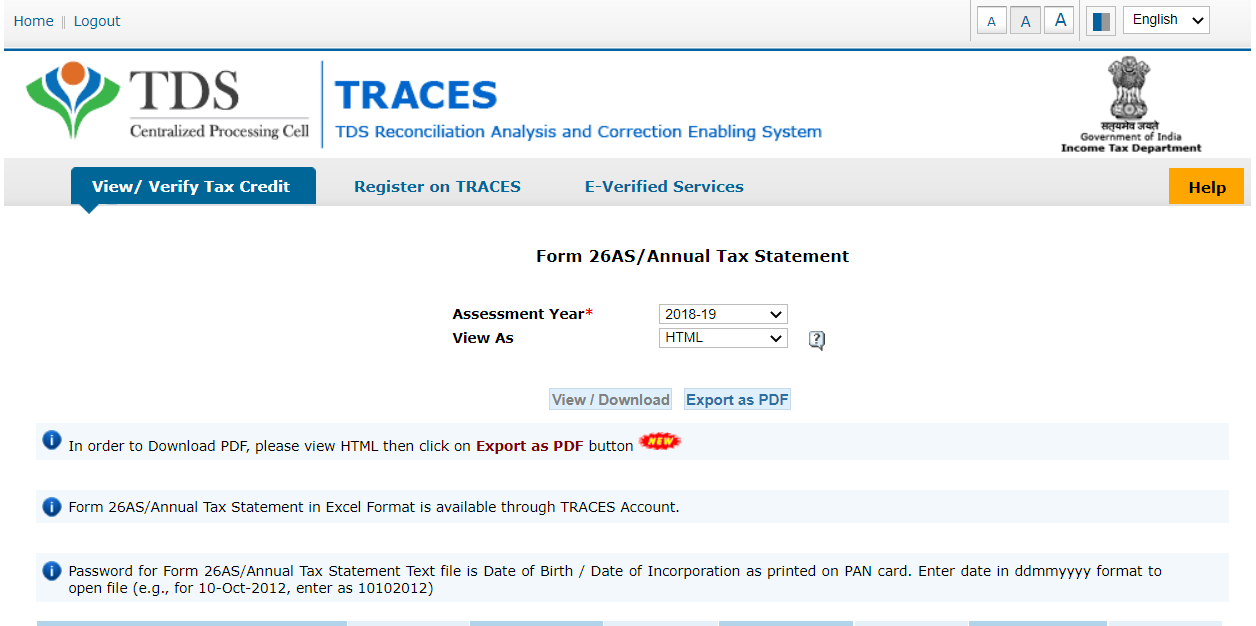

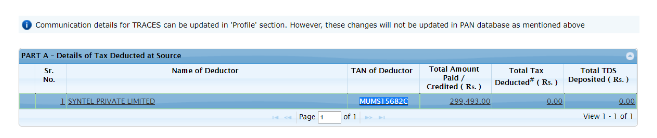

7. Select the Assessment Year

If you have worked with more than one employer during the year, you will have more than one Form 16.

Select the “Assessment year” of your previous employer & select the file format in “View As”

Click on “View/Download” -> TRACES portal will fetch the related data and display the result

If you want to download the result Click on “Export as PDF”

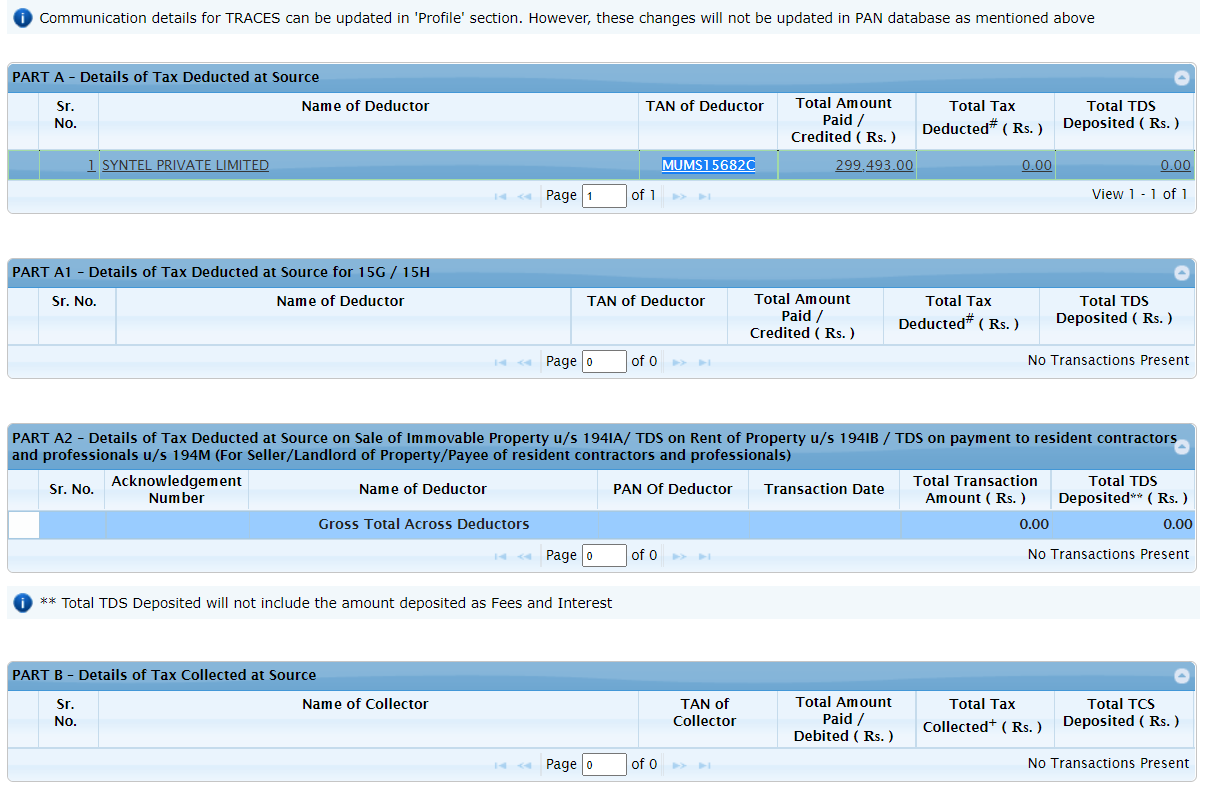

8.Copy the TAN Number of Deductor

TAN means Tax Deduction & Collection Account Number that is allocated to every employer to facilitate tax payments to the government

Copy the Employer TAN number from “TAN of Deductor”

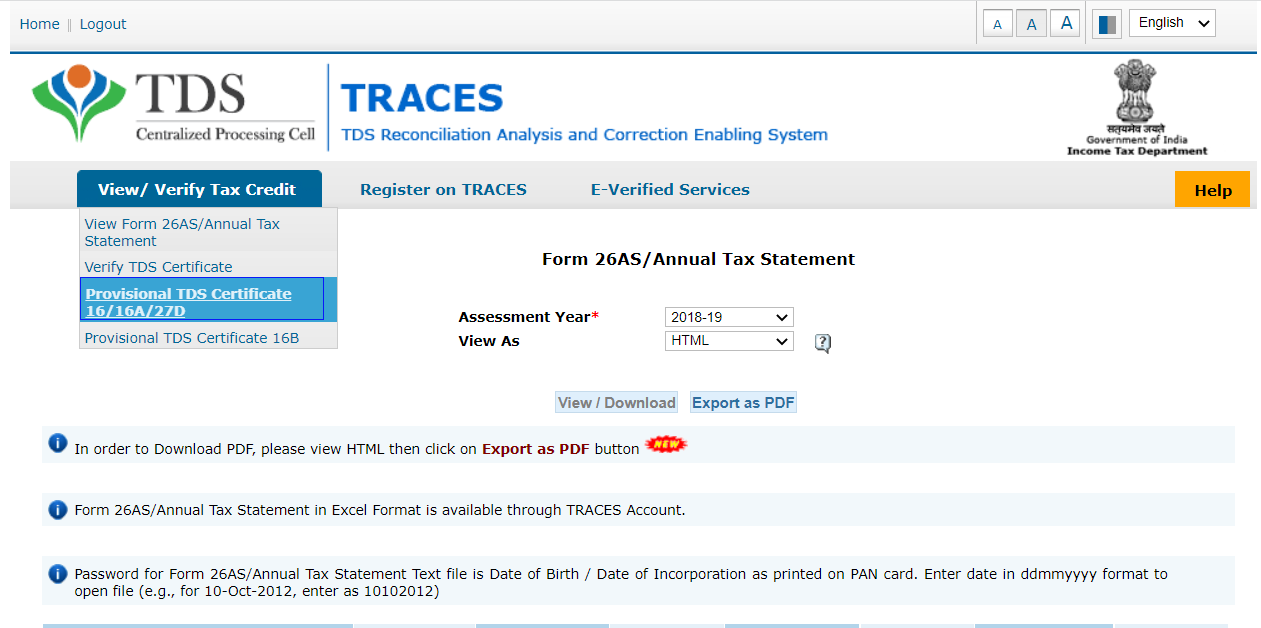

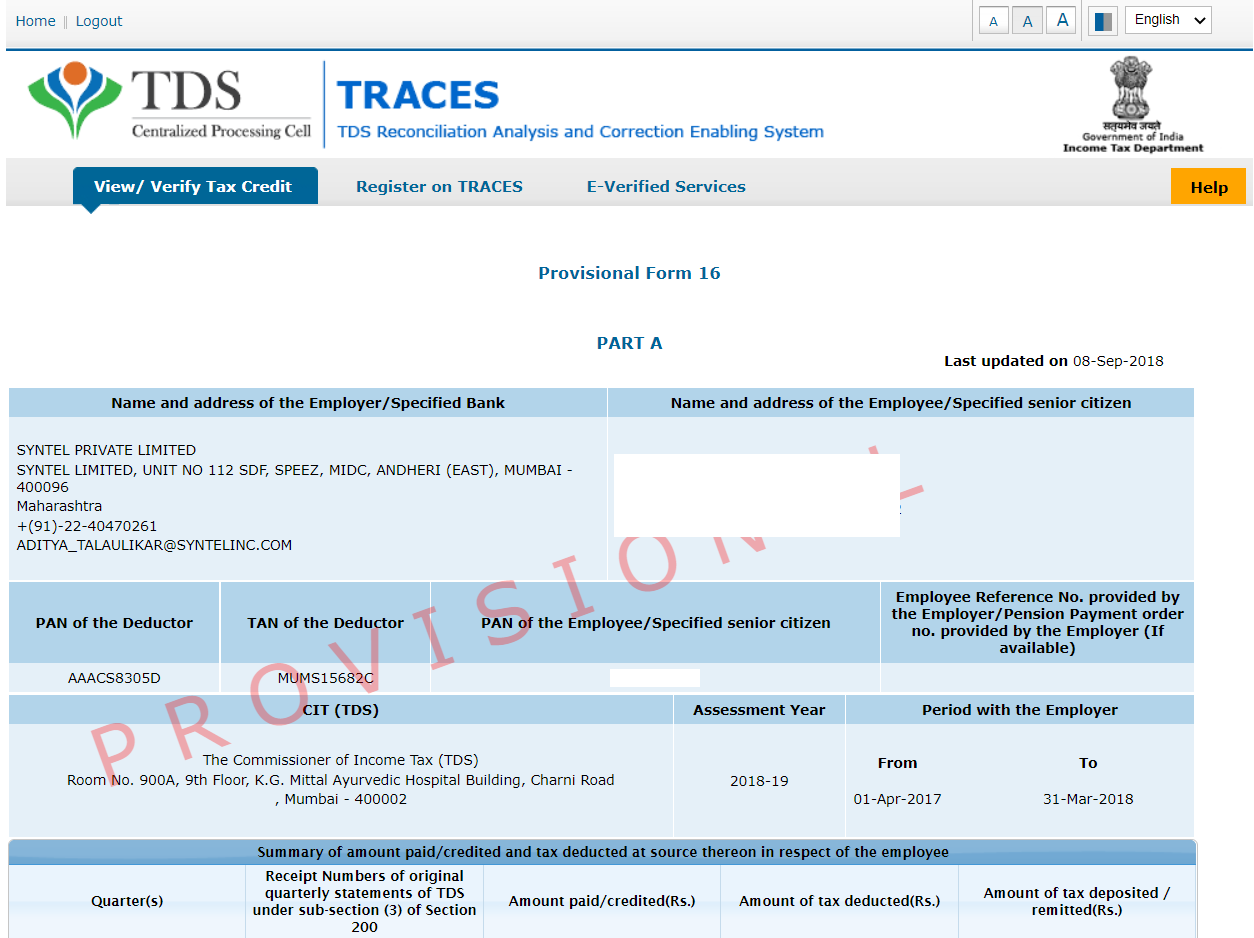

9.Navigate to Provisional TDS Certificate

Go to View/ Verify Tax Credit > Provisional TDS Certificate 16/16A/27D

10.Filter with valid TAN & Financial Year

Enter the TAN of Deductor (Copied earlier), Financial year and Select the “Provisional Certificate Type” as 16 and Click on “View”

Once you select the Financial Year, the Assessment year will be assigned automatically & it will be 1 year ahead of the Financial year.

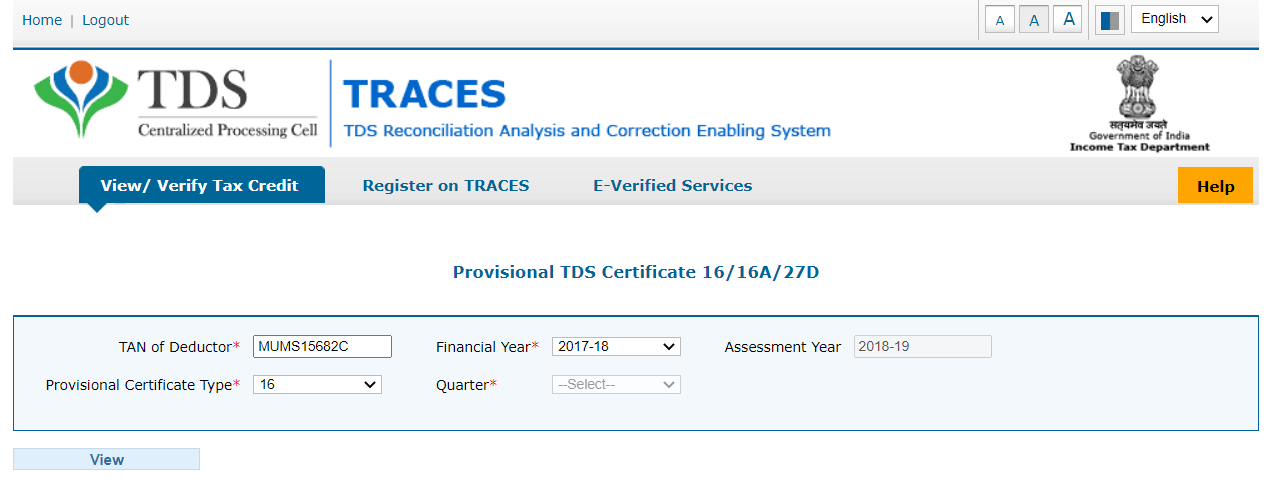

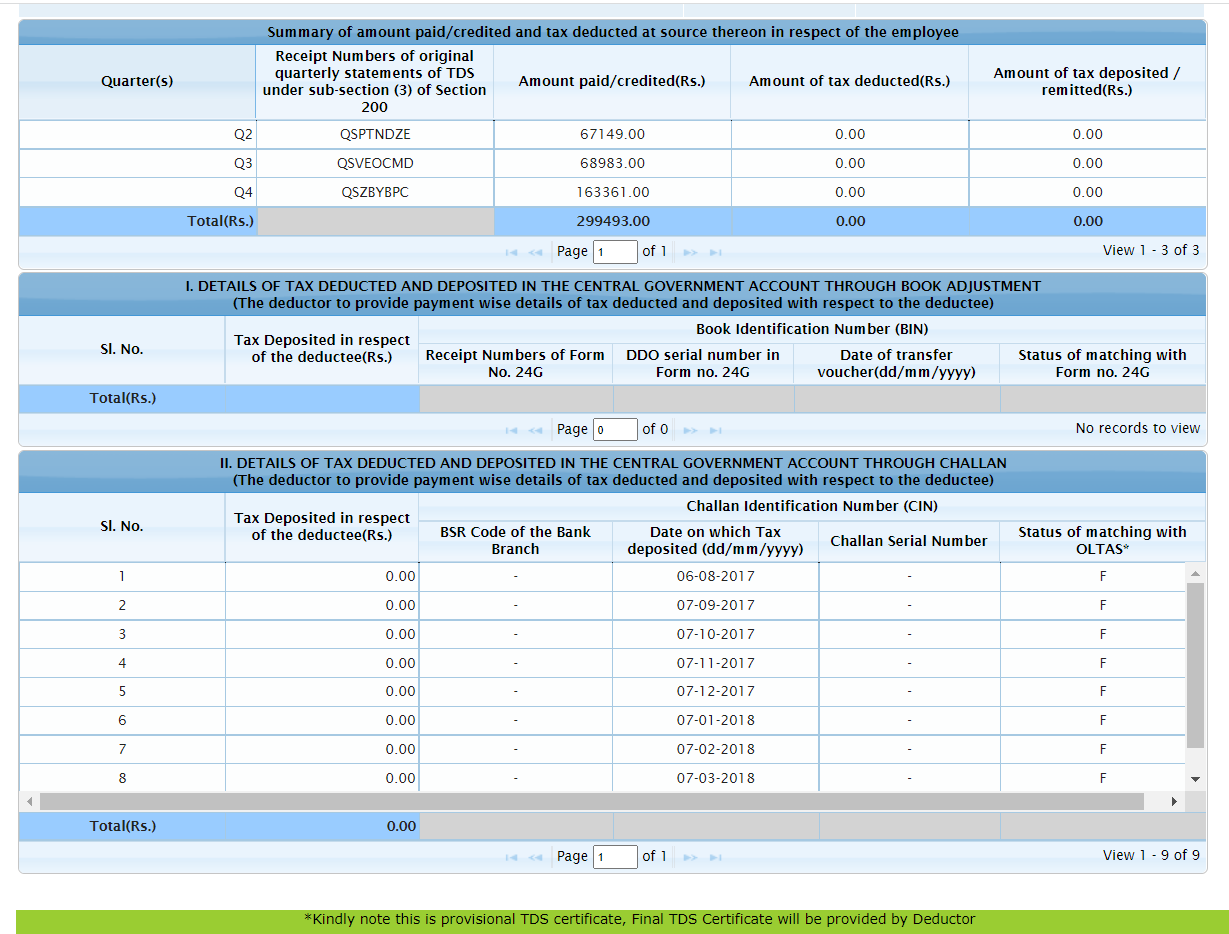

11.View & Download Provisional Form 16

Based on the filter, PART A of the TDS Certificate will be displayed in TRACES.

If you want the copy of the form, Right click > Save as > HTML Document will be downloaded in your system.

After completing the above steps you will receive the Part A of Form 16. Kindly note this is a provisional TDS Certificate, Final TDS certificate will be provided by Deductor.

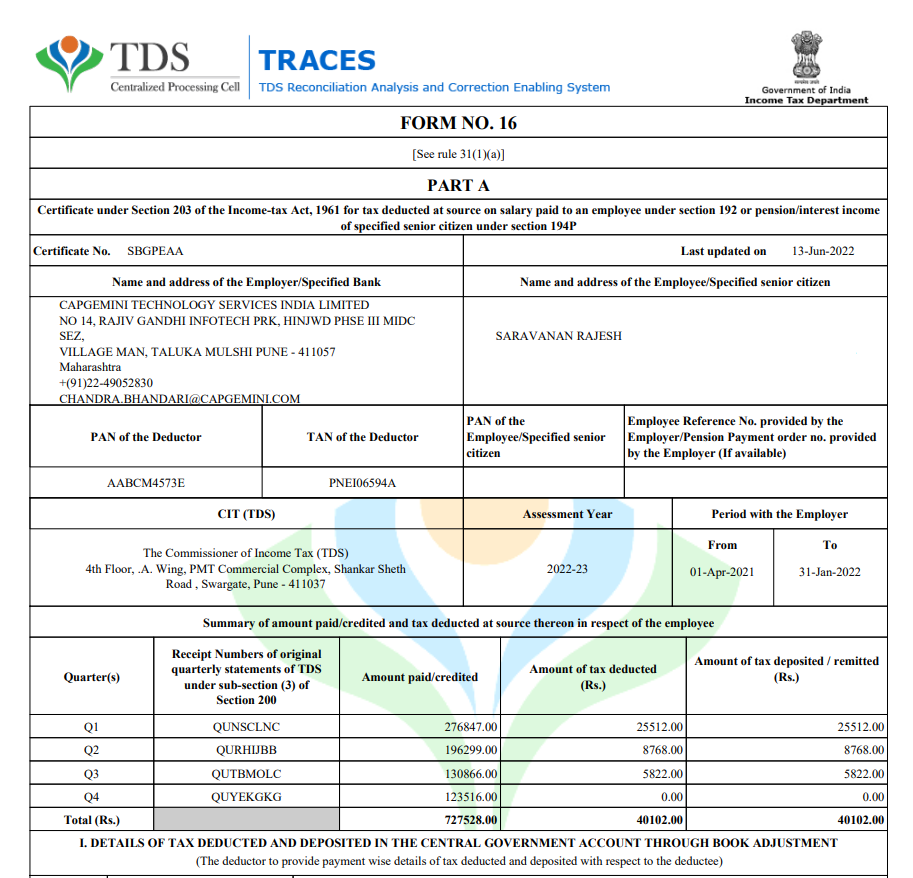

Usually Form 16 will be sent to your Company’s mail id from the employer. If you are part away from your company it will be sent to your personal mail id.

Original Form 16 will have Part A and Part B and I have mentioned the sample Form 16 for your reference. It will have 4 to 6 pages.

FAQ’s

1.What is Form 16?

Form 16 is a confirmation certificate issued by an employer that TDS has been deducted and deposited with the government on behalf of the employee in a particular financial year

2.Who is Eligible for Form 16?

As per the Income Tax Act, before making the Salary or Payment an employer deducts the TDS from the employee’s income, the employer must provide the Form 16 to the employee.

3.How to Download Form 16?

Form 16 consists of Part A & Part B. Salaried individuals cannot download Part B of Form 16 online, they must go through the process of filling out the form and submitting it to the employer. Employers can download Form 16 Part A & Part B from the TRACES. Employees can download Part A of Form 16 using the above mentioned steps.

4.What is the eligibility criteria for Form 16?

If an employee’s income is less than Rs.2.5 lakhs for the financial year they are exempted from paying the Income Tax. A company can offer the Form16 to its employees if they fall under the tax bracket.

5.Why is Form 16 needed?

Form16 is compulsory if you want to file your Income Tax Returns online, take a Bank loan or apply for a credit card and are necessary for obtaining a Passport and Visa.

6.When is Form 16 issued ?

The employer should issue the Form 16 on or before May 31 of the assessment year, it will give the enough time to file your ITR.

Meet Rajesh

I am Rajesh from India, the founder and owner of byrajesh.com

Currently I am working as an Automation Test Analyst in an MNC Company, while working in a comfortable position I always think of my future and next move.

COPYRIGHT ©2022, BY byrajesh. ALL RIGHTS RESERVED.